New California Law Requirements Expands Salary Transparency and Reporting

On September 27, 2022, California joined several other states that require increased pay transparency in the workplace under the new legislation (Senate Bill 1162), which goes into effect on January 1, 2023. The New California Law, Bill 1162 requires employers with current and prospective employees to disclose salary ranges, include salary information in job postings, and maintain detailed statistics and statistics regarding workforce demographics and salaries. Along with internal employees, all contingent workers supplied by staffing agencies must be included. “Labor contractor” means an individual or entity that supplies, either with or without a contract, a client employer with workers to perform labor within the client employer’s usual course of business.

According to the Senate Bill 1162, the key takeaways are:

Effective January 1st:

- All employers will be required to share pay scale information with current employees, upon request.

- All employers will be required to maintain records of job descriptions and wage history for employees while they are employed and for three years after employment ends.

- Companies with 15 or more employees must include pay scale information in all job postings.

Effective May 10th, 2023:

- Companies with 100 or more employees (or 100 or more employees hired through labor contractors, such as staffing agencies) must comply with new data reporting requirements that expand upon the Equal Employment Opportunity Commission’s EEO-1 form and existing California law.

According to California Legislative, the pay data report shall include the following information:

(1) The number of employees by race, ethnicity, and sex in each of the following job categories:

(A) Executive or senior level officials and managers.

(B) First or mid-level officials and managers.

(C) Professionals.

(D) Technicians.

(E) Sales workers.

(F) Administrative support workers.

(G) Craft workers.

(H) Operatives.

(I) Laborers and helpers.

(J) Service workers.

(2) The number of employees by race, ethnicity, and sex, whose annual earnings fall within each of the pay bands used by the United States Bureau of Labor Statistics in the Occupational Employment Statistics survey.

(3) Within each job category, for each combination of race, ethnicity, and sex, the median and mean hourly rate.

(4) For purposes of establishing the numbers required to be reported under paragraph (1), an employer shall create a “snapshot” that counts all of the individuals in each job category by race, ethnicity, and sex, employed during a single pay period of the employer’s choice between October 1 and December 31 of the “Reporting Year.”

(5) For purposes of establishing the numbers to be reported under paragraphs (2) and (3), the employer shall calculate the total earnings, as shown on the Internal Revenue Service Form W-2, for each employee in the “snapshot,” for the entire “Reporting Year,” regardless of whether or not an employee worked for the full calendar year. The employer shall tabulate and report the number of employees whose W-2 earnings during the “Reporting Year” fell within each pay band.

(6) The employer shall include in the report the total number of hours worked by each employee counted in each pay band during the “Reporting Year.”

(7) The report shall include the employer’s North American Industry Classification System (NAICS) code.

Civil penalties can be $100 per employee upon any employer who fails to file the required report and $200 per employee upon any employer for a subsequent failure to file the required report.

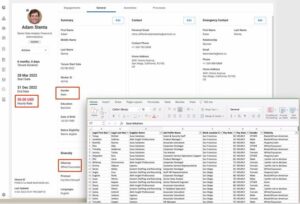

Many clients have taken advantage of our NO-COST Workforce & Vendor Management programs to alleviate any concerns with this new bill, their contingent workers and approved staffing providers. This worker tracking is just one of the many benefits that a customized managed service program can capture.

If you have questions or concerns regarding SB 1162 or other employment law issues, please do not hesitate to contact Suna Solutions.

Kyle Anderson, Total Talent Solutions Manager

Kyle Anderson, Total Talent Solutions Manager